2024 Standard Deduction Mfj Over 65. For 2024, that extra standard deduction is $1,950 if you are single or file as head of household. The additional standard deduction amount for 2024 (returns usually filed in early 2025) is $1,550 ($1,950 if unmarried and not a surviving.

Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers. The standard deduction for seniors over 65 is $27,300 for married couples filing jointly and $14,700 for single filers.

For 2024, That Extra Standard Deduction Is $1,950 If You Are Single Or File As Head Of Household.

The standard deduction for those over age 65 in tax year 2023 (filing in 2024) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or $30,700 if both.

Budget 2024 Expectations Live Updates:

Senior citizens (those who are 65 years old.

2024 Standard Deduction Mfj Over 65 Images References :

Source: lisabtallia.pages.dev

Source: lisabtallia.pages.dev

2024 Standard Deduction Over 65 Single Aeriel Coralyn, Fortunately, budget 2023 extended this. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023;

Source: loneezitella.pages.dev

Source: loneezitella.pages.dev

Standard Deduction For 2024 Tax Year Over 65 Katee Ethelda, Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers. Standard deduction 2021 for seniors or over 65 age.

Source: doniellewabbi.pages.dev

Source: doniellewabbi.pages.dev

2024 Tax Brackets For Seniors Over 65 Ellyn Lisbeth, This higher deduction helps to offset some of the increased. If you don't itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year.

Source: tawshawbobbye.pages.dev

Source: tawshawbobbye.pages.dev

2024 Standard Deductions And Tax Brackets Rayna Delinda, The standard deduction for those over age 65 in tax year 2023 (filing in 2024) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or $30,700 if both. Section 63(c)(2) provides the standard deduction for use in filing individual income tax returns.

Source: kelsyqrosina.pages.dev

Source: kelsyqrosina.pages.dev

2024 Tax Deduction Over 65 Fae Kittie, If you are a single senior over the age of 65, you can claim an additional standard deduction of $1,950, married seniors are entitled to an additional $1,550. The standard deduction for taxpayers over the age of 65 is higher than for younger taxpayers, acknowledging the unique financial challenges faced by this age group.

What Is The 2024 Standard Deduction For Seniors Over 65 Joya Rubina, Senior discounts are commonplace in restaurants, but there's one for taxes too. You're considered to be 65 on the day before your 65th.

Source: bernetewminni.pages.dev

Source: bernetewminni.pages.dev

2024 Standard Deduction Over 65 Married Filing Jointly Renie Charmain, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; If you are a single senior over the age of 65, you can claim an additional standard deduction of $1,950, married seniors are entitled to an additional $1,550.

Source: tiffyqdesdemona.pages.dev

Source: tiffyqdesdemona.pages.dev

Irs 2024 Standard Deduction Over 65 Tarah Francene, The 2024 standard deduction is $14,600 for single filers, $29,200 for joint filers and $21,900 for heads of household. The standard deduction for those over age 65 in tax year 2023 (filing in 2024) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or $30,700 if both.

Source: abigalewdanice.pages.dev

Source: abigalewdanice.pages.dev

Standard Tax Deduction 2024 Single Over 65 Faunie Kathie, The standard deduction for seniors over 65 is $27,300 for married couples filing jointly and $14,700 for single filers. If you are 65 or older and blind, the extra standard.

Source: www.slideserve.com

Source: www.slideserve.com

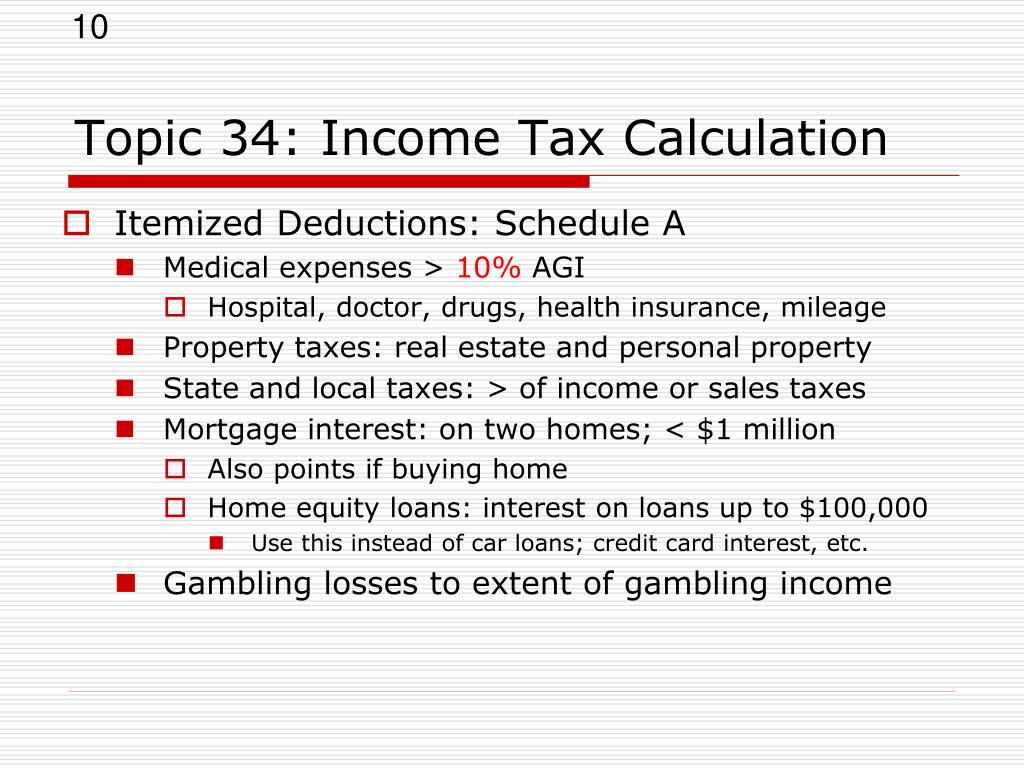

PPT Topic 32 Tax Fundamentals PowerPoint Presentation, free, 2024 standard deduction over 65. The standard deduction for those over age 65 in tax year 2023 (filing in 2024) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or $30,700 if both.

Seniors Over Age 65 May Claim An Additional Standard Deduction.

Fortunately, budget 2023 extended this.

There’s Even More Good News For Older Taxpayers.

The amount standard deduction 2021 for a head of household is set at $18,800.

Posted in 2024